Lightning security suggestions by The Texas Insurance coverage Podcast – Cyber Tech

TDI specialists reply Texans’ prime auto insurance coverage questions.

What ought to auto insurance coverage value, and what’s the perfect type to get?

To reply a query about value, you should know what a coverage covers first. TDI’s automotive insurance coverage information may also help, and there’s a coverage comparability device at www.opic.texas.gov. It’s essential to know what you want, as a result of a cheaper price could not provide you with sufficient protection. For those who reside in an space with hailstorms, tornadoes, or flooding, you want extra protection than somebody who doesn’t.

Why do my neighbors pay much less for auto insurance coverage than I do?

Insurance coverage firms take a look at plenty of components after they set charges: age, driving report, claims historical past, the place you retain your automobile. In addition they take a look at whether or not the realm has storms, if you happen to park behind a locked gate, otherwise you’re in a high-crime space. They’ll take a look at your credit score rating too. So it’s commonplace for neighbors to have completely different charges.

How can I decrease my automobile insurance coverage prices?

Begin with good driving habits. Drive defensively, keep underneath the velocity restrict, don’t take a look at your telephone. For those who insure a young person, you will get reductions for good grades or drivers ed courses. You may also save if you happen to get dwelling, life, and auto from the identical firm. And there are mileage-based insurance coverage if you happen to drive lower than you probably did earlier than COVID-19. Don’t be afraid to ask your insurance coverage firm for a reduction.

Why do insurance coverage charges in Texas appear increased than in different places?

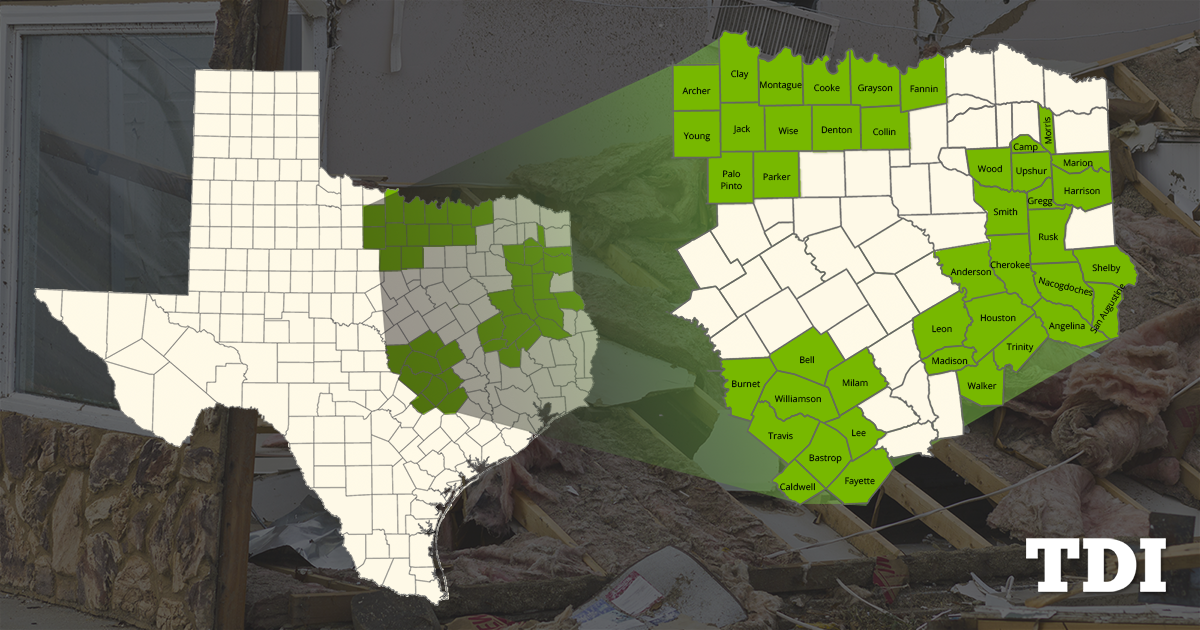

Texas is exclusive. We have now each type of local weather: coast, mountains, plains, hills. Some components of the state are vulnerable to flooding and hurricanes. Different components have tornadoes and hailstorms. Some states could have one or two of these, however Texas has all the things, so it prices extra to insure towards all of it.

What’s the distinction between legal responsibility and complete insurance coverage?

If the accident is your fault, legal responsibility insurance coverage takes care of it. Each driver in Texas is required to have legal responsibility. Complete and collision protection, alternatively, takes care of harm to your automobile or truck no matter whose fault the accident was.

You is perhaps tempted to skip complete to avoid wasting just a few {dollars}, however bear in mind, if you happen to hit anyone at a stoplight and it’s your fault, your legal responsibility gained’t pay to repair your automobile. So you should do the mathematics to see what sort of protection you want and what you may afford.

Ought to I purchase the insurance coverage automobile rental firms attempt to promote me?

It relies upon. For those who simply need additional peace of thoughts, it is perhaps price it. Each coverage is completely different, so ask your insurance coverage agent first. You may already be lined. Consider some insurance policies will cowl a rental automobile on a trip, however not if you happen to lease for a piece journey or as a result of your automobile is within the store. Ensure to verify your coverage.

Are bank card loyalty applications actual protection?

These are protection choices, however they’re not technically insurance coverage. TDI can’t assist you to with them if there’s an issue.

Whose insurance coverage covers accidents after I borrow a automobile?

For those who borrow a automobile with permission, the proprietor’s coverage goes to pay in an accident. You might need some protection from your individual coverage, particularly if you happen to get harm. However if you happen to borrow a automobile so much, you should look into “non-owners” protection, or an uninsured motorist coverage that offers you private damage safety if you’re in another person’s automobile.

Ought to I get “hole protection” after I purchase a brand new automobile?

A brand new automobile loses worth if you drive it off the lot. For those who complete the automobile, your insurance coverage pays you that decrease worth, not what you paid for the automobile when it was new. Hole protection helps cowl that distinction.